When should I refinance my mortgage?

Mortgage Refinancing: How It Works and How It Can Save You Money

Refinancing your mortgage can be a smart financial move that helps you reduce your monthly payments, lower your interest rate, or even tap into your home's equity. But how do you know if it’s the right time for you to refinance? In this guide, we’ll break down what refinancing is, why homeowners choose to do it, and how you can determine if it makes sense for your financial situation.

What is Refinancing?

Refinancing is the process of replacing your existing mortgage with a new loan, typically with better terms. This new loan pays off your current mortgage, and you start making payments on the new one.

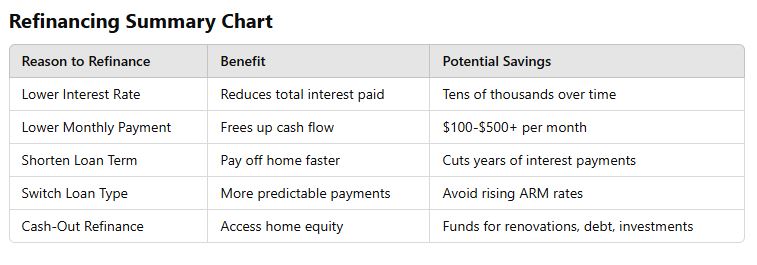

Homeowners refinance for several reasons, including:

- Lowering their interest rate

- Reducing their monthly mortgage payments

- Switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage

- Shortening the loan term (e.g., moving from a 30-year to a 15-year loan)

- Accessing home equity through a cash-out refinance

Why Do People Refinance?

1. Lowering Interest Rates

One of the main reasons homeowners refinance is to secure a lower interest rate, which reduces the overall cost of borrowing. Even a small drop in your interest rate can lead to substantial savings over the life of the loan.

For example:

- If you have a $300,000 mortgage at 6% interest and refinance to a 4% rate, you could save hundreds per month and tens of thousands over the loan's lifetime.

2. Lowering Monthly Payments

A lower interest rate or a longer loan term can lead to lower monthly mortgage payments. This frees up cash flow for other financial goals, such as investing, saving, or paying off high-interest debt.

3. Switching Loan Types

Some homeowners start with an adjustable-rate mortgage (ARM) with lower initial payments but later switch to a fixed-rate mortgage for stability and predictability.

4. Shortening the Loan Term

Refinancing can also help you pay off your mortgage faster. If you refinance from a 30-year mortgage to a 15-year loan, you’ll pay off your home in half the time and save significantly on interest. However, your monthly payments may be higher.

5. Tapping Into Home Equity (Cash-Out Refinance)

A cash-out refinance allows homeowners to borrow against their home’s equity, using the funds for renovations, debt consolidation, or other financial needs.

Example:

- If your home is worth $400,000 and you owe $250,000, you could refinance for $300,000 and receive $50,000 in cash.

Is It the Right Time to Refinance?

If you’re considering refinancing, ask yourself these key questions:

✅ What’s the lowest interest rate I can qualify for?

✅ How much will I save per month compared to my current payment?

✅ What are the costs of refinancing, and how long will it take to break even?

Example: Does Refinancing Make Financial Sense?

Let’s say:

- You currently pay $2,500/month on your mortgage.

- A refinance could lower your payment by $500/month.

- The refinance fees (closing costs, origination fees, etc.) total $10,000.

How long will it take to recoup the refinancing costs?

- Divide the cost of refinancing ($10,000) by your monthly savings ($500).

- $10,000 ÷ $500 = 20 months (just over 1.5 years).

- After that, you’ll save $500 per month for the rest of the loan.

Over 28.5 years, that’s a total savings of $171,000!

How to Get Started with Refinancing

- Check Your Credit Score – A higher credit score can help you qualify for lower interest rates.

- Compare Loan Offers – Shop around for the best refinance rates from different lenders.

- Calculate the Break-Even Point – Ensure the cost of refinancing makes sense in the long run.

- Gather Your Documents – Lenders will require income statements, tax returns, and home appraisals.

- Consult a Mortgage Expert – A mortgage professional can help guide you through the process.

Final Thoughts

Refinancing can be a powerful financial tool if done correctly. Whether you want to lower your monthly payments, secure a better interest rate, or access your home’s equity, it’s crucial to do the math and make sure refinancing aligns with your goals.

If you’d like to know how much you can save on your mortgage, reach out for a free consultation today! (714) 656-6325

Ruben Sanchez

REALTOR® | Team Lead

(714) 656-6325

DRE 02091617 | NMLS 2096373

ΓEA⅃ Brokerage

Categories

Recent Posts

GET MORE INFORMATION