Why a Preapproval Letter is Crucial Before House Hunting

If you're considering buying a home, obtaining a mortgage preapproval letter should be your first step before house hunting. A preapproval letter proves that a lender has evaluated your financial situation and is willing to extend a loan, subject to final underwriting. This document can streamline your home buying process, strengthen your offer in a competitive market, and prevent unnecessary disappointments down the road.

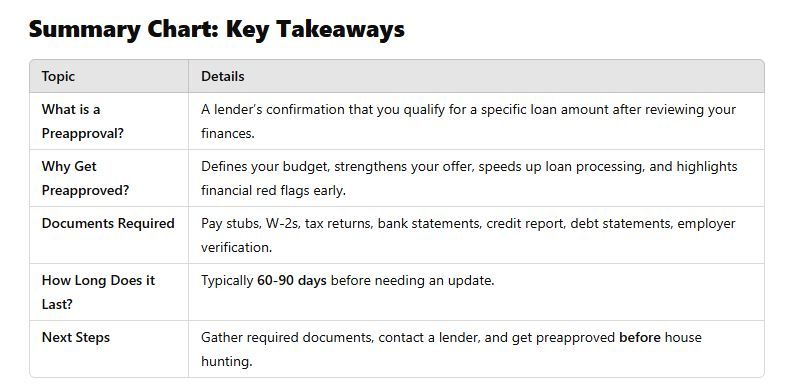

What is a Preapproval Letter?

A mortgage preapproval letter is an official document from a lender stating that you qualify for a certain loan amount based on a review of your financial background. Unlike a prequalification—which is an informal estimate—a preapproval involves a thorough analysis of your credit, income, and assets.

Why You Need a Preapproval Before Shopping for a Home

-

It Defines Your Budget

- A preapproval letter clarifies how much house you can afford, preventing you from falling in love with homes outside your financial reach.

-

It Strengthens Your Offer

- In a competitive housing market, sellers prefer buyers with preapproval letters because it shows you’re serious and financially prepared. Some sellers won't even consider offers without one.

-

It Speeds Up the Loan Process

- Since preapproval involves initial underwriting, it reduces delays when finalizing your mortgage.

-

It Highlights Financial Red Flags Early

- If there are issues with your credit score, debt-to-income ratio (DTI), or employment verification, a preapproval allows you to fix them before making an offer.

-

It Gives You Negotiating Power

- If you’re competing against other buyers, sellers may choose you over someone who hasn’t been preapproved.

What Documents Do You Need for a Mortgage Preapproval?

Lenders require financial documents to verify your ability to repay a loan. Here are the key items needed:

Income & Employment Verification

✔ Pay Stubs – Typically, your last 30 days of income statements

✔ W-2 Forms – For the last 2 years

✔ Tax Returns – Self-employed individuals must provide two years of personal and business tax returns

✔ Employer Verification – Some lenders will call your employer for confirmation

Credit & Debt Information

✔ Credit Report & Score – Lenders will pull your credit history from all three bureaus

✔ Debt Statements – Including car loans, student loans, and credit cards

Assets & Liabilities

✔ Bank Statements – At least two months of checking & savings accounts

✔ Investment & Retirement Accounts – 401(k), IRA, or stock portfolio statements

✔ Down Payment Source – If using gift funds, lenders may require a gift letter confirming the source

Additional Documentation (Case-by-Case Basis)

✔ Divorce Decree – If applicable for child support/alimony obligations

✔ Bankruptcy/Foreclosure Records – If applicable

✔ Rental History – If not currently a homeowner

How Long Does a Preapproval Last?

Most mortgage preapprovals are valid for 60 to 90 days. If you don’t find a home within that timeframe, you may need to update your financial documents and obtain a new preapproval.

Final Thoughts

Getting preapproved before house hunting is a smart move that saves time, reduces stress, and strengthens your offer. It gives you a realistic budget, allows you to fix financial issues upfront, and ensures you're prepared when you find the perfect home.

Ready to Get Preapproved?

If you’re serious about buying a home, now is the time to gather your documents and speak with me so I can connect you with my loan specialist. Call or text me at (714) 656-6325.

A preapproval could be the key to landing your dream home!

Ruben Sanchez

REALTOR® | Team Lead

(714) 656-6325

DRE 02091617

ΓEA⅃ Brokerage

Categories

Recent Posts

GET MORE INFORMATION